A Business Plan for Life

Having a plan with the flexibility to deal with changes and life issues is critical. This is the cornerstone of our planning philosophy; we call it a business plan for life.

The strategy is based on cash flow and tax impact, rather than insurance and investments, and can effectively deal with multiple what if scenarios at any point in time.

True wealth management planning should:

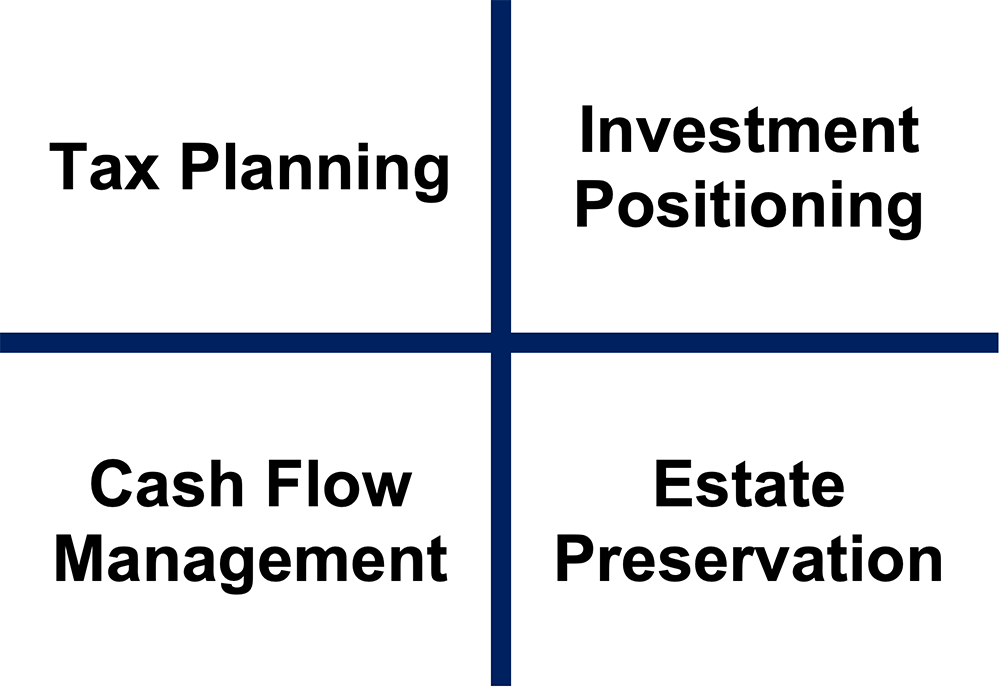

1. Integrate and coordinate all forms of planning.

2. Be based in cash flow and tax, not insurance and investments – this provides for a realistic assessment of the viability of the plan to that person’s specific situation, now and in the future.

3. Provide multiple “what if” scenarios for now and down the road, to prepare for all of life’s “consistent inconsistencies.”

4. Endeavor to quantify freedoms – the sole focus should not be on saving as much as you can, but on determining the specific freedoms you can take, allowing you to enjoy guiltlessly what you have sacrificed, disciplined, and worked so hard for.

The Business Plan for Life is exactly that: it regards your estate (everything you own) as a business and manages it with the same hands-on scrutiny it takes to run it successfully

RESULT: The creation of a much more serious awareness as to the importance of addressing all areas of planning and the impact each has on the others.